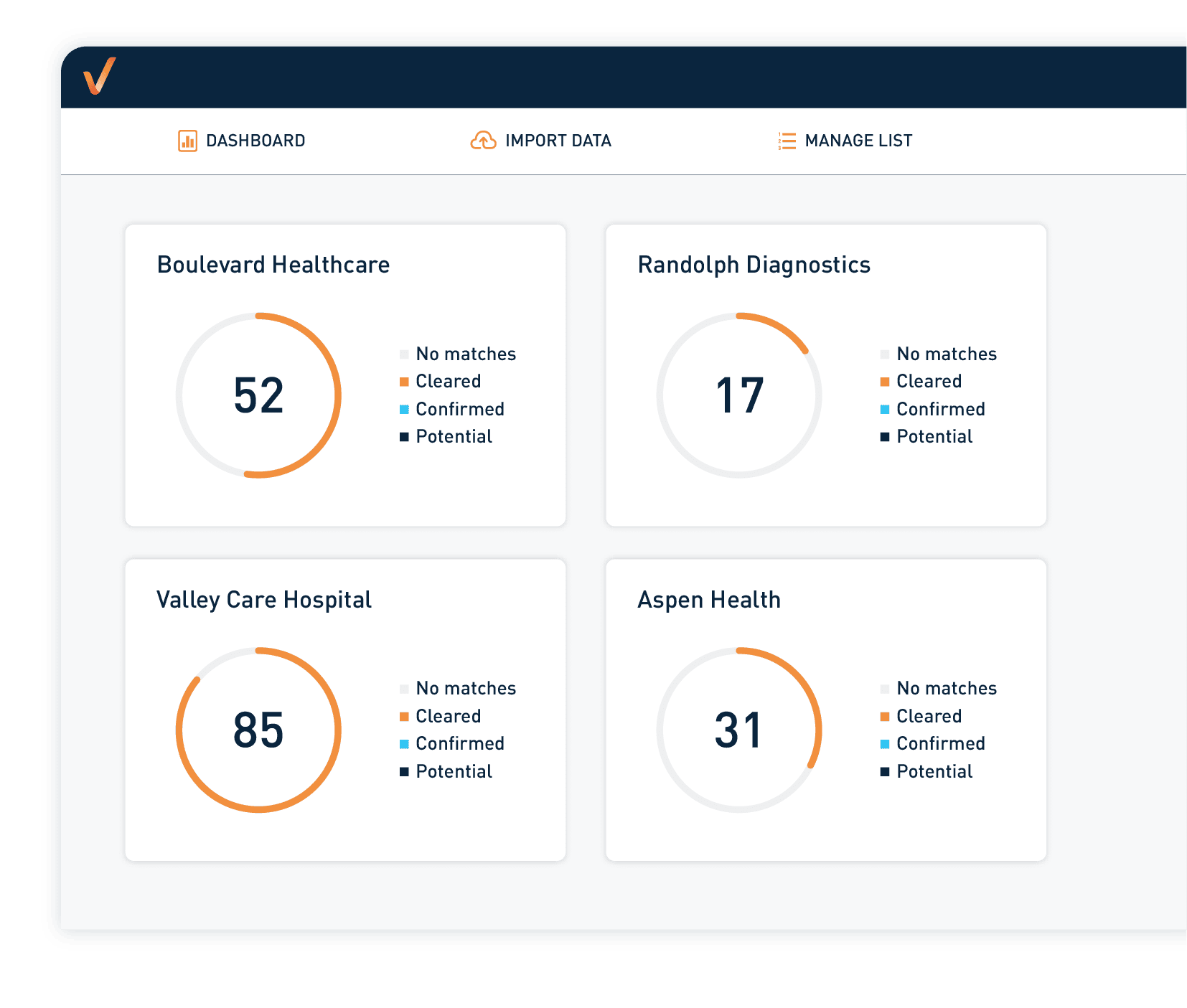

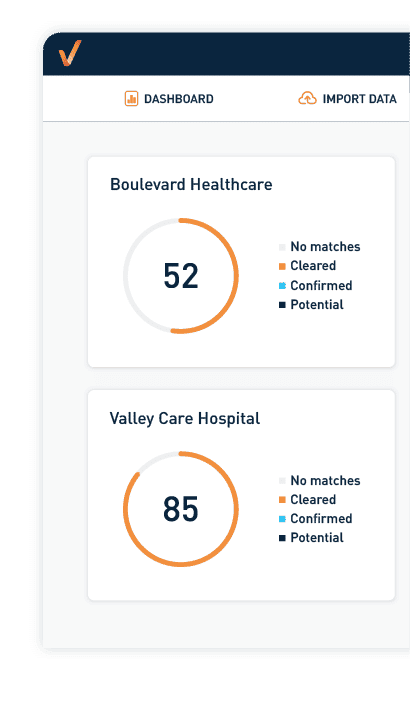

Verify Everything. Miss Nothing.

One-stop portal to identify and resolve compliance screening issues – fast!

STREAMLINE VERIFY IS THE FUTURE OF COMPLIANCE

Our API integration offers a faster, more efficient way to execute Exclusion Screening and Credential Management

Recent OIG Penalties & Affirmative Exclusions

Trusted by over 10,000 establishments

Learn why over 10,000 establishments have trusted us to streamline their workflow for more than a decade.